Timeline Tales

Exploring the stories that shape our world, one timeline at a time.

Why Guessing Costs More: The Truth Behind Insurance Comparison

Unlock the secret to saving on insurance! Discover why guessing costs you more and how to make smarter comparisons for the best deals.

The Hidden Costs of Guessing: Understanding Insurance Comparison

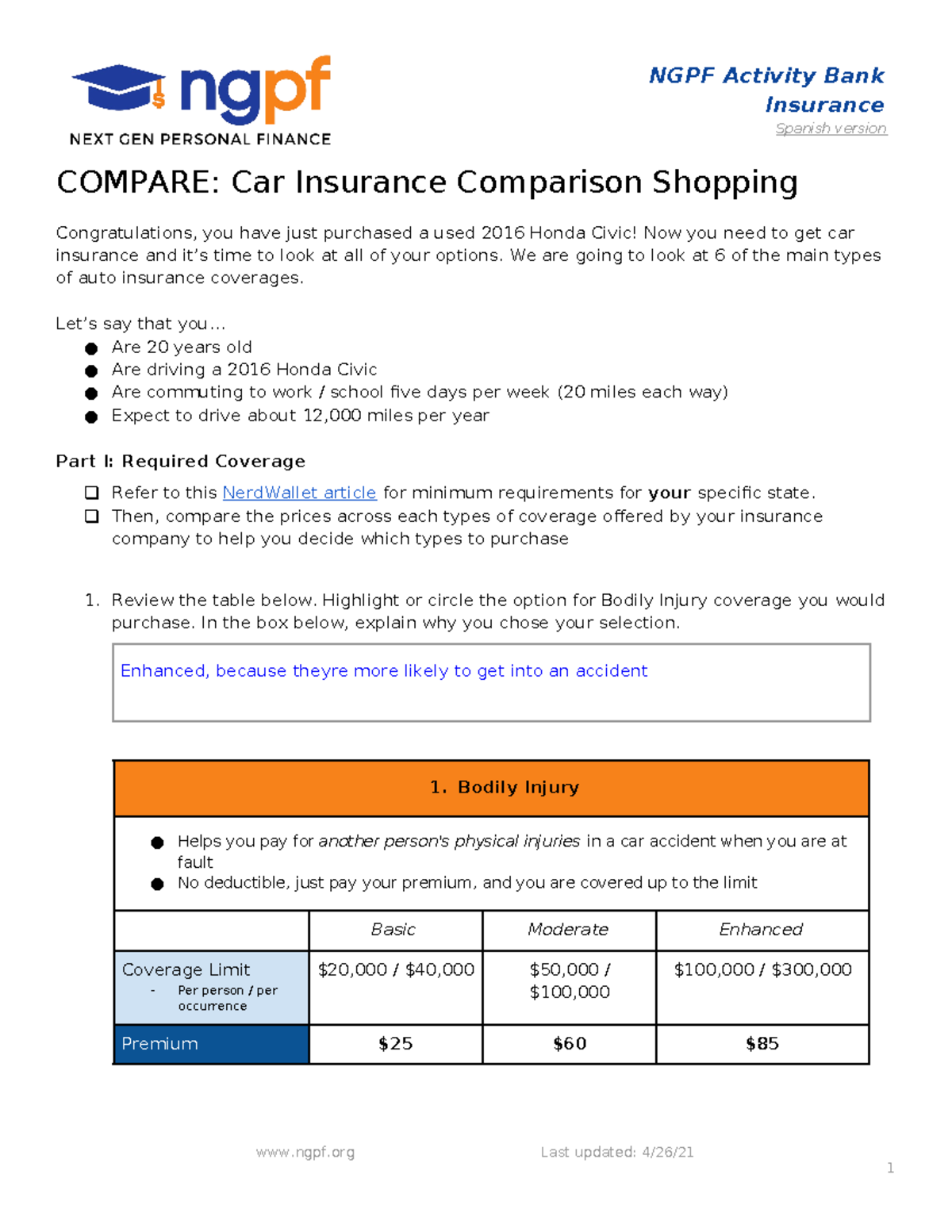

When it comes to selecting the right insurance policy, guessing can lead to costly mistakes. One of the primary hidden costs associated with taking a haphazard approach to insurance comparison is the risk of overpaying for coverage. If you fail to thoroughly compare policies, you might choose a plan that does not offer the best value for your needs, resulting in higher premiums and inadequate coverage. The complexity of different policies, terms, and conditions can further complicate your decision, making it essential to employ a detailed comparison approach rather than relying on estimates or assumptions.

Another hidden cost of guessing in insurance comparison is the risk of being underinsured. Without proper evaluation and comparison of various options, you may inadvertently select a policy with insufficient coverage for your specific circumstances, leaving you vulnerable to financial loss in the event of an accident or disaster. According to the Insurance Information Institute, a comprehensive assessment of your needs, including a comparison of deductibles, premiums, and benefits, is crucial for ensuring adequate protection. To avoid these pitfalls, utilize dedicated comparison tools or consult with an insurance advisor who can provide personalized insights.

Is It Worth the Risk? The Importance of Accurate Insurance Quotes

When it comes to securing the right insurance coverage, accurate insurance quotes are absolutely essential. Obtaining precise quotes allows consumers to understand the true cost of policies, ensuring that they are not underinsured or overpaying. Furthermore, without accurate information, individuals may encounter unexpected financial burdens following a claim. It’s crucial to compare different policies and their associated costs to make informed decisions. By utilizing tools and resources that provide expert insights, consumers can better navigate the often complex world of insurance and mitigate potential risks.

However, the endeavor to find accurate quotes can be fraught with challenges. Many consumers may rush through the process, inadvertently providing incorrect information or failing to examine policy details closely. According to research from The National Association of Insurance Commissioners, inaccuracies in quotes can lead to serious consequences down the line, including claim denials. Thus, taking the time to gather detailed and accurate information is critical. Always remember, investing time in getting reliable quotes can safeguard your financial future, making it worth the risk.

Common Mistakes in Insurance Comparison That Could Cost You More

When it comes to insurance comparison, many people fall into the trap of only looking at the premiums. However, this narrow focus can lead to significant coverage gaps that may end up costing you more in the long run. For instance, it's crucial not to overlook factors such as deductibles, coverage limits, and the exclusions in each policy. Failing to take these elements into account can lead you to choose the cheapest option, which might not provide the protection you actually need in case of an emergency.

Another common mistake is not utilizing comparison tools effectively. Many consumers end up relying on a single website or tool without verifying the information against multiple sources. This can result in an inaccurate assessment of available policies. Moreover, neglecting to read customer reviews and asking questions can leave you uninformed about the insurer's customer service, claims process, and overall reliability. To avoid these pitfalls, always ensure you're comparing multiple options and conducting thorough research to make an informed decision.