Timeline Tales

Exploring the stories that shape our world, one timeline at a time.

Insurance Coverage: Don’t Get Caught Naked in a Storm

Protect yourself from unexpected risks! Discover essential insurance coverage tips to stay safe and secure in any storm.

Understanding the Different Types of Insurance Coverage: What You Need to Know

When it comes to protecting your assets, understanding the different types of insurance coverage is essential. There are several primary categories of insurance that individuals and businesses should be aware of:

- Health Insurance: Protects against medical expenses.

- Auto Insurance: Covers vehicle-related incidents.

- Homeowners Insurance: Provides financial protection against damage to your home.

- Life Insurance: Offers financial security to your beneficiaries upon your death.

- Disability Insurance: Replaces income if you’re unable to work due to illness or injury.

Understanding these types of coverage can help you choose what's best for your circumstances. For more information on each category, you can visit NerdWallet for a comprehensive overview.

Additionally, it’s vital to recognize the nuances within each type of coverage. For example, auto insurance can include liability, collision, and comprehensive coverage, each offering different levels of protection. Similarly, homeowners insurance can cover various perils, such as theft and natural disasters, but the specific terms will depend on your policy. Always read the fine print to understand what is and isn't covered. If you're looking for detailed advice tailored to your needs, the Insurance Information Institute provides valuable resources.

Are You Adequately Covered? Common Gaps in Insurance Policies

When it comes to safeguarding your assets, it’s crucial to evaluate whether you are adequately covered by your insurance policies. Many individuals unknowingly leave themselves vulnerable due to common gaps in insurance policies. For instance, standard homeowner's insurance might not cover natural disasters like floods or earthquakes unless additional coverage is purchased. According to the Federal Emergency Management Agency (FEMA), understanding these limitations is the first step toward comprehensive protection.

Another frequent oversight involves liability coverage, which can vary significantly between policies. Many people assume their auto insurance will cover all liabilities, but that’s not always the case. In fact, gaps in coverage can leave you financially exposed in the event of an accident beyond the limits of your policy. To adequately protect yourself, regularly review your policies and consult resources such as the Insurance Information Institute to identify potential shortcomings and ensure you have the necessary coverage.

How to Choose the Right Insurance Coverage for Your Needs

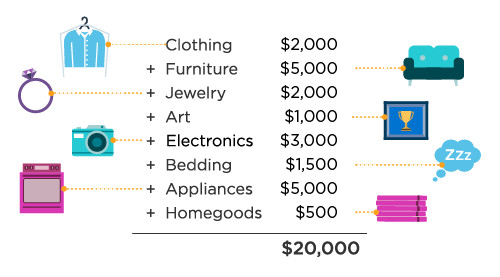

Choosing the right insurance coverage is essential for protecting your financial future and ensuring peace of mind. To begin, assess your personal needs by considering factors such as your assets, liabilities, and lifestyle. Create a list of specific coverage types you may require, such as homeowners insurance, health insurance, or auto insurance. It's also helpful to evaluate any existing policies to determine whether they adequately meet your needs. Regularly reviewing and adjusting your coverage will ensure it remains relevant as your personal circumstances change.

Once you have a clear understanding of your needs, it's crucial to compare different policies to find the best fit. Start by gathering quotes from multiple providers and analyzing the coverage limits, deductibles, and premiums. Resources like NerdWallet can help you compare options easily. Additionally, don't hesitate to consult with a licensed insurance agent who can offer personalized advice based on your unique situation. Remember, the cheapest policy might not always provide the best protection, so carefully weigh your options to ensure you make an informed decision.