Timeline Tales

Exploring the stories that shape our world, one timeline at a time.

Renters Insurance: Because Your Stuff Deserves a Bodyguard

Protect your belongings like a pro! Discover why renters insurance is the ultimate bodyguard for your possessions today.

Top 5 Reasons Why Renters Insurance is Essential for Your Peace of Mind

When it comes to renting a home or apartment, renters insurance is an essential safeguard that can provide significant peace of mind. Unlike homeowners, renters often don't have coverage for their personal belongings against theft, fire, or other unexpected incidents. By investing in renters insurance, you can protect your belongings against losses, ensuring that you're not left to shoulder the financial burden alone. Consider this scenario: if a fire were to damage your apartment, without insurance, you would be responsible for replacing everything out of pocket. However, with renters insurance, you will have coverage to help recover those losses.

Aside from protecting your personal property, renters insurance also offers liability coverage, which can be crucial in unexpected situations. For instance, if someone were to slip and fall in your rented space, a renters insurance policy could cover legal expenses and medical bills, keeping you safe from potential financial ruin. Additionally, most policies are quite affordable, often costing less than a tank of gas each month. Therefore, by understanding the many advantages of having renters insurance, you can confidently protect yourself and your belongings, which contributes greatly to your overall peace of mind.

What Does Renters Insurance Actually Cover? A Comprehensive Guide

When renting a home or apartment, it's crucial to understand what renters insurance actually covers. Generally, this type of insurance protects your personal belongings from various risks such as theft, fire, and vandalism. Most policies typically include coverage for items like furniture, electronics, clothing, and personal items. However, it's essential to review your specific policy to know the limits and exclusions. Many renters often underestimate the value of their possessions, so conducting a comprehensive inventory is a smart step to ensure adequate coverage.

In addition to personal property coverage, renters insurance often includes liability protection. This means that if someone is injured in your rented space and decides to take legal action, your insurance can help cover the legal fees and damages, up to your policy limit. Moreover, some policies offer additional living expenses coverage, which covers costs associated with temporary housing if your rented space becomes uninhabitable due to a covered event. Understanding these components can help you make informed decisions about your renters insurance policy and ensure you are adequately protected.

How to Choose the Right Renters Insurance Policy for Your Needs

Choosing the right renters insurance policy begins with assessing your individual needs and circumstances. It's essential to start by making a comprehensive list of your belongings, including high-value items such as electronics, jewelry, and furniture. This list will help you determine the amount of coverage necessary to protect your assets effectively. Furthermore, consider factors like whether you live in a high-risk area prone to theft or natural disasters, as these elements may influence the type and level of coverage you require.

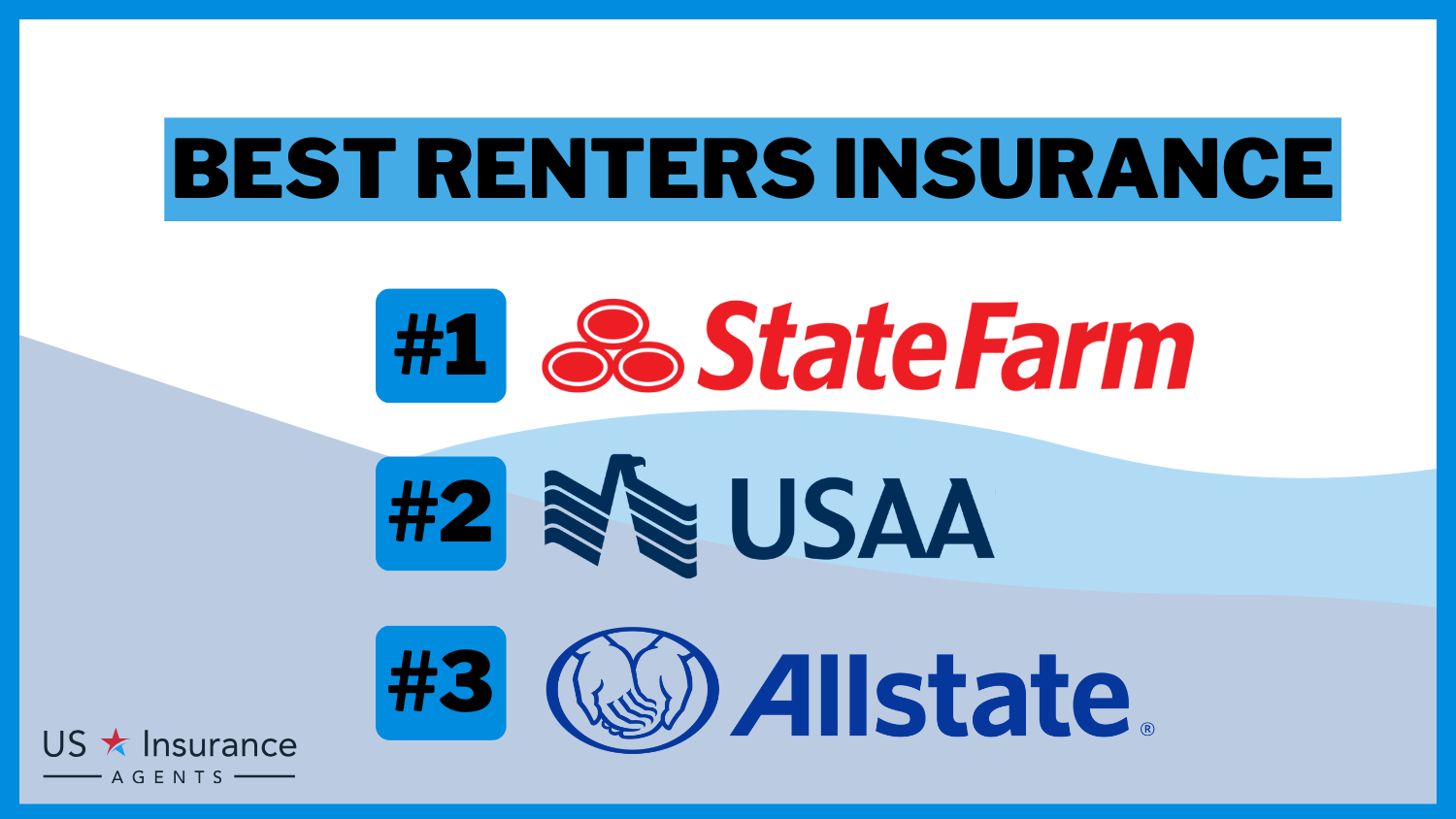

Once you have a clear understanding of your needs, it’s time to compare different policies. Look for key features such as liability coverage, which protects you in case of accidents that occur in your rental unit, and loss of use coverage, which can help cover living expenses if your rental becomes uninhabitable due to a covered event. Utilize online tools to compare quotes from various insurers and read customer reviews to gauge their reputation for service and claims handling. By taking these steps, you can confidently select a renters insurance policy that fulfills your specific requirements.